Commercial UK debt recovery

Overdue accounts damaging your cash flow? Pre-Audit purge to limit write-off potential? Acquisition ledger clean-up or Due Diligence prior to purchase? Ledger retirement, such as liquidation and business pre-sale? Temporary lack of resource or seasonal pressure on resources? Small account recovery while you focus on key accounts?

We can help.

Whether you have ad hoc or regular debts to place with us, we check your buyer’s solvency and liquidity and plan our recovery tactics. We then add Late Payment of Commercial Debts Act costs and interest to your outstanding sum and contact your debtor. When your debtor pays the principal sum, costs and interest, your customer foots our bill.

Using  to recover your UK commercial debts gives you:

to recover your UK commercial debts gives you:

Protecting your reputation and minimising costs

We adopt a collaborative rather than combative recovery approach with prompt actions. We first check your debtor’s financial strength to give our collector an informed negotiation advantage. This advantage quickly deflects from the most prolific non-payment excuse, namely poor cash flow, moving us onto admission of debt and a commitment to pay. We always try to solve any queries or concerns ourselves, reverting to you only when we cannot. Should payment remain outstanding after thirty days, we recommend the next course of action that may include legal action, although this is more the exception than the rule.

Keeping you in the loop

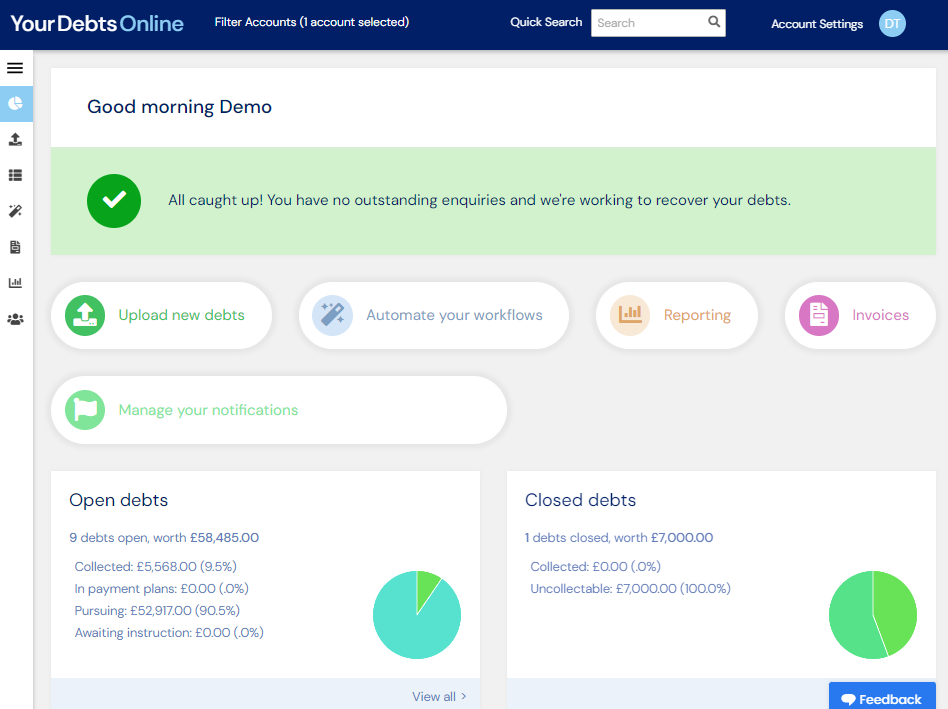

Our online portal, Your Debts Online (YDO), keeps you informed of our efforts on your behalf, lets you instruct and inform us in real-time, and contains your invoices and statements, with your collected funds remitted weekly by BACS.